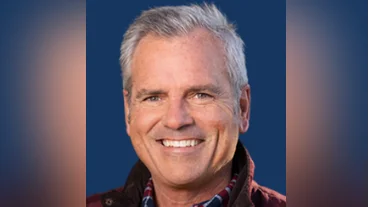

Rep. Mark Alford, U.S. Representative for Missouri's 4th District | Ballotpedia

Rep. Mark Alford, U.S. Representative for Missouri's 4th District | Ballotpedia

This week, Congressman Mark Alford (MO-04), co-chair of the bipartisan Congressional Real Estate Caucus, along with fellow co-chairs Representatives Lou Correa (CA-46), Tracey Mann (KS-01), and Brittany Pettersen (CO-07), urged the Federal Housing Finance Agency (FHFA) to halt its Title Acceptance Pilot program. The lawmakers addressed their concerns in a letter to Sandra Thompson, Director of the FHFA.

The members argue that the pilot program, which suggests title insurance is a "junk fee," could cause significant harm to homeowners and lenders by leaving them without essential protection against financial loss. They stated: “Buying a home represents the largest and most important acquisition Americans make in their lifetime, and purchasing title insurance secures that investment by protecting against financial loss from threats like unrecorded liens, fraud, and forgery.”

They further expressed that the pilot would not achieve its goal of reducing closing costs safely but might instead increase risks for homeowners and lenders. Since FHFA announced the pilot, there has been notable bipartisan opposition from state and federal lawmakers, including Congress members, the National Council of Insurance Legislators, and fourteen Attorneys General.

The members emphasized: “Relying simply on an automated title search using public records alone will leave consumers susceptible to hidden threats not found in other records like unfiled liens, fraud, and forgery.” They noted that removing trained title agents from this process under the pilot could expose consumers to substantial risk.

Recently included in a Consumer Financial Protection Bureau's Request for Information on "junk fees," title insurance was classified as such by some. This classification may devalue it or encourage consumers to skip it altogether. The members concluded: “Title insurance provides critical protections to homebuyers and lenders, and we do not support any efforts that would undermine those protections.”

In addition to Alford, Correa, Mann, and Petterson, several other representatives signed the letter urging reconsideration of the pilot program.

Diane Tomb, CEO of the American Land Title Association said: “Title insurance is the most effective way to protect homeowners and lenders against future financial loss... The FHFA Title Acceptance Pilot is a misguided policy...” Dr. Mark Fleming from First American Financial Corporation added insights on how title insurance continues providing protection even after issues arise post-closing.

Alerts Sign-up

Alerts Sign-up