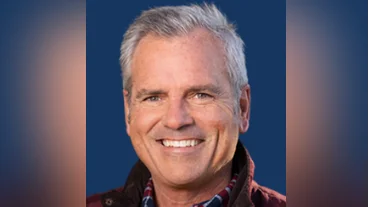

Rep. Mark Alford, U.S. Representative for Missouri's 4th District | Ballotpedia

Rep. Mark Alford, U.S. Representative for Missouri's 4th District | Ballotpedia

U.S. Congressman Mark Alford recently joined Ways and Means Committee Chairman Jason Smith and U.S. Congressman Ron Estes in Kansas City for a roundtable discussion aimed at addressing potential tax increases. The event, held at Superior Linen Supply Company, focused on how Congress can build upon the 2017 Trump tax cuts to prevent a $7 trillion tax hike proposed by the Biden-Harris administration.

Congressman Alford expressed the importance of such discussions, stating, "It was an honor to join Chairman Jason Smith and the Ways and Means Committee for a critical roundtable discussion at Superior Linen Supply Co. in Kansas City. This meeting allowed us to directly speak with local business and insurance leaders, whose firsthand experiences are vital in shaping our legislative efforts."

Chairman Smith emphasized the financial struggles faced by American families and businesses under the current administration, noting, “After more than 100 Tax Teams events in 19 states, one thing is clear – American families, small businesses, and farmers who are already struggling in the Biden-Harris economy cannot afford a tax increase next year."

The Kansas City roundtable is part of over a hundred events organized by the Ways and Means Committee Tax Teams across the country. These events aim to prepare legislative solutions before key provisions of President Trump's 2017 tax law expire.

During the discussion, participants highlighted crucial elements of the Trump tax cuts such as the Section 199A small business deduction and Opportunity Zones. They stressed these provisions' significance for business expansion, job creation, community investment, and wage growth.

Attendees from various industries voiced concerns about potential consequences if these provisions were allowed to expire. They warned that this could lead to increased tax rates for small businesses.

The event included representatives from companies like Superior Linen, H&R Block, Lockton Companies, Xtreme Gymnastics & Motus Ninjas, Rieger Distillery, Crossland Construction, Burns & McDonnell, T-Mobile, 4-State Supply, Black & Veatch, and J.E. Dunn.

Alerts Sign-up

Alerts Sign-up